Plan Your Cash Like a Pro with Full Credit Cycle Awareness

awrfi shows you how upcoming statements, grace periods, and payment schedules will impact your cash weeks in advance, helping you make smarter decisions and avoid surprises.

Bank statements look backward. Spreadsheets fall behind. awrfi looks ahead, giving you a real-time, dynamic view of what's coming.

How It Works

Awrfi helps small business owners take control of their daily cash position and plan ahead with precision.

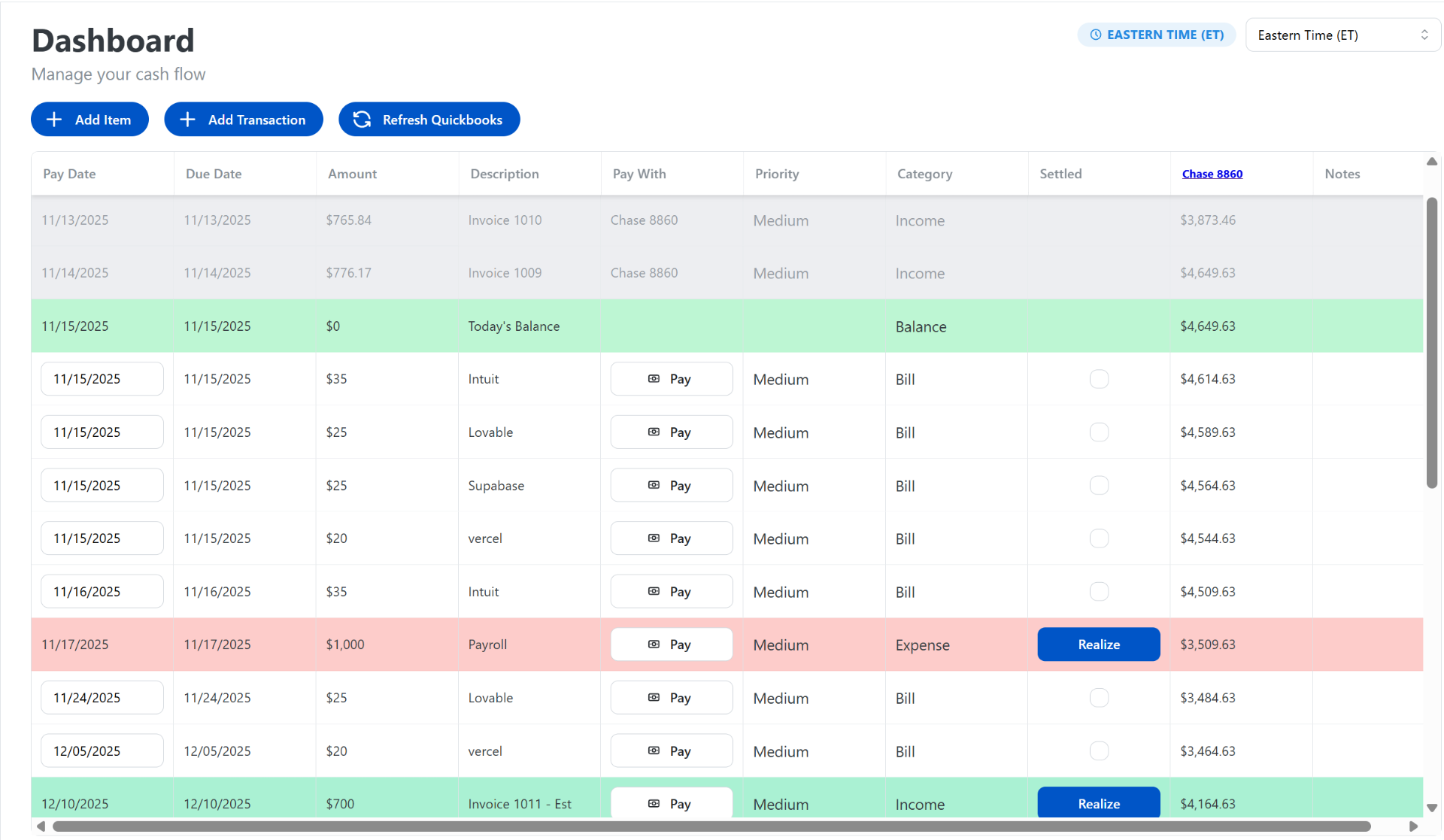

Daily Cash Flow Planning

Organize bills, expenses, income, and financing on a daily timeline to plan weeks or months in advance.

Payment-Aware Forecasting

Track credit card statement dates, LOC cycles, and terms to understand how today's activity impacts future cash.

Smart Cash Availability Tracking

Instantly see committed vs. available cash with live calculation across AP, expected income, and more.

Early Payment Optimization

Calculate early payment discounts and assess whether to prepay or hold cash for flexibility.

Built for Financial Clarity

Everything you need to understand and control your business cash flow.

Unified Cash & Credit View

See all bank accounts and credit cards in one place with real-time impact on future cash.

Predictive Cash Balance

Automatic forecasting that understands credit cycles, grace periods, and upcoming charges.

Intelligent Payment Scheduling

Schedule payments to vendors. When both use awrfi, receivables appear automatically.

Real-Time Scenario Analysis

See the instant impact of paying bills today vs. next week on your cash position.

Designed for Operators

Simple interface requiring no finance background. Confidence for business owners.

Network Effect

Connect with partners and vendors for unprecedented visibility into future transactions.

Bank statements look backward. Spreadsheets fall behind. awrfi looks ahead, giving you a real-time, dynamic view of what's coming.

BEFORE

•

Manual spreadsheet tracking

•

Historical bank statements only

•

Guesswork and uncertainty

•

No credit cycle visibility

•

Delayed payment decisions

•

Reactive cash management

AFTER

Real-time predictive forecasting

Unified cash + credit view

Complete clarity and confidence

Automatic credit cycle tracking

Instant scenario analysis

Proactive cash optimization

Simple, Transparent Pricing

Join our beta program and get full access to Awrfi completely free while we perfect the platform.

Free

Limited time Beta

Full access to all features

Unlimited bank & card integrations

Advanced cash flow forecasting

Real-time alerts & reporting

Priority support & feature requests

No credit card required • Cancel anytime

Real Results from Our Pilot Customer

Movatik • Outdoor Sports Retailer • $20M Annual Revenue

"Awrfi gives me real-time visibility into our entire cash position. I can plan 60 days ahead with confidence, knowing exactly what's available and where we can deploy free cash for growth."

Treasurer, Movatik

2+ years using Awrfi

$0 in Interest Paid

Optimized payment timing using credit-cycle forecasting

$1.5M in Monthly Cash Tracked

All inflows and outflows in real-time, in one dashboard

Zero Cash Shortfalls

Proactive scheduling and forecasting keep liquidity intact

100+ Alerts & Reports Generated

Automatic insights on cash risks and summary reports

Why We Built Awrfi

Awrfi started as an internal tool when co-founder Federico D'Ambrosio was facing liquidity concerns that no existing platform could solve. It was built to bring visibility, precision, and control to day-to-day cash management by factoring in credit cycles, payables, and real-time availability. The tool helped restore clarity during a financially critical period, and now it's evolving to help other small business owners do the same.

Get started with Awrfi today

© 2024 Awrfi. All rights reserved.